How to play:

With Varo Bank: Mobile Banking, users can register and enjoy the financial services it provides through various methods. Here is a detailed step-by-step guide:

1、 Register an account

Register through the official website:

Visit the official website of Varo Bank.

Click on the registration link or button and enter your email address.

Follow the prompts on the page, enter your email, phone number, password, and agree to the terms of service.

After submission, you will receive a verification email. Click on the link in the email to complete the email verification.

Download and register the app through the app store:

Search for "Varo Bank" on the App Store or Google Play and download the app.

Open the app, select to register as a new user, and fill in relevant information, including name, Social Security Number (SSN), date of birth, and residential address.

Agree to the terms of service and complete the registration process.

2、 Complete personal information and verification

Fill in personal information:

Fill in your personal information in detail on the app or official website, including but not limited to name, address, phone number, etc.

If necessary, upload relevant supporting documents such as ID card, passport, or driver's license (specific requirements may vary by region).

Verify identity:

According to Varo Bank's requirements, you may need to provide additional identity verification information, such as bank statements, tax invoices, or other official documents.

These files can be uploaded to the app by taking photos or by uploading PDF files through specified links.

3、 Using Varo Bank's services

Open a bank account:

After completing registration and verification, you will be able to open a bank account with Varo Bank.

The account can be a checking account or a savings account, depending on your needs.

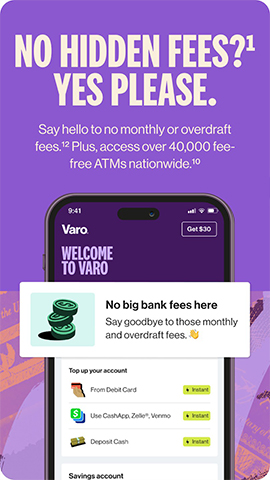

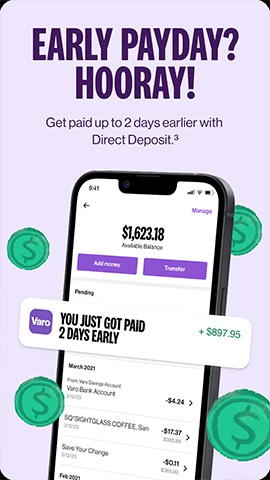

Deposit and withdrawal:

Deposit salary or other funds directly into your Varo Bank account.

You can use Varo Bank's debit card to access over 40000 Allpoints in the United States ® Free withdrawal at ATM, but please note that it is not an Allpoint ® ATM machines may charge additional fees.

Transfer and Payment:

Use the Varo Bank app for transfers, including free transfers to other Varo Bank users.

You can also set up automatic savings tools to automatically transfer funds from your bank account to your savings account.

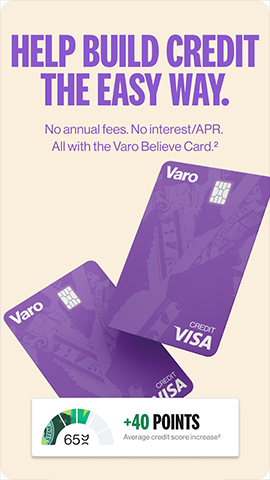

Credit Construction:

If you meet the criteria, you can apply for the Varo Believe credit card, which is a secured credit card designed to help you establish credit.

Repaying on time and maintaining a good credit record will help improve your credit score.

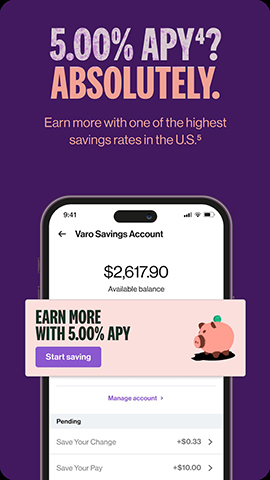

Enjoy high interest savings:

Varo Bank offers high interest savings accounts with an annual interest rate of up to 5% (APY), but the specific interest rate depends on your account balance and direct deposit situation.

Ensure compliance with relevant requirements to enjoy the highest interest rate.

Other services:

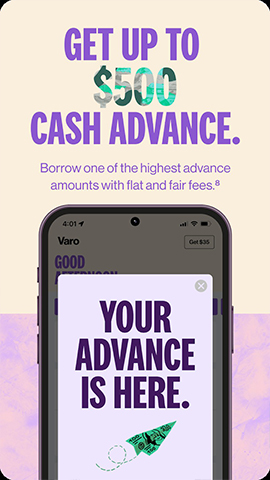

Varo Bank also offers Varo Advance, which allows you to borrow up to $500 when needed.

Please note that the specific terms and conditions of these services may vary depending on individual circumstances.

4、 Precautions

When using Varo Bank services, please be sure to comply with its terms of service and privacy policy.

Regularly check your account balance and transaction records to ensure account security.

If you encounter any problems or doubts, please contact Varo Bank's customer service team promptly for assistance.

By following the above steps, you can easily register and start using the convenient financial services provided by Varo Bank: Mobile Banking.