How to play:

The detailed steps for using Chime Mobile Banking mainly include the following parts:

1、 Download and Install

Download Chime application:

Search for "Chime" in the mobile app store, find the official application, download and install it.

2、 Register an account

Open the application: After installation is complete, open the Chime application.

Fill in personal information:

According to the prompts, fill in personal information, including name, email address, mobile phone number, etc. Please ensure that this information is accurate and error free for subsequent verification and operation.

Chime may request verification of the phone number by sending a verification code for confirmation.

Verify identity:

Provide necessary authentication information, such as a Social Security Number (SSN), etc. This is to ensure the security and compliance of the account.

Note: Chime primarily provides services to US citizens or legal permanent residents, therefore legal identification is required.

3、 Set up account

Set password and PIN code:

Create a secure login password, typically consisting of a combination of letters, numbers, and special characters.

Set up a PIN code for security verification during daily transactions and login.

Enable biometric technology (optional):

Chime provides biometric technologies such as fingerprint recognition and facial recognition to enhance account security. Users can choose to enable it according to their personal needs.

4、 Bind bank account

Add bank account:

Select 'Add Bank Account' in the application and follow the prompts to fill in the relevant information to complete the binding of the bank account and Chime account.

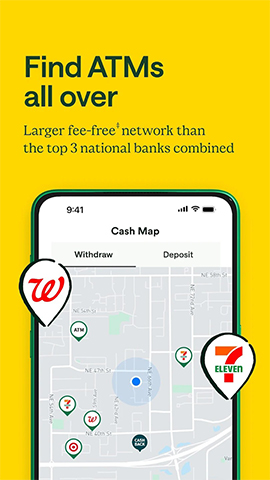

After binding the bank account, users can easily perform recharge and withdrawal operations.

5、 Start using

Enjoy comprehensive financial services:

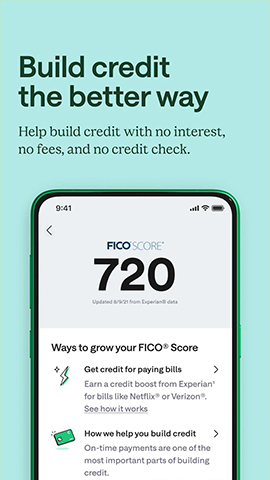

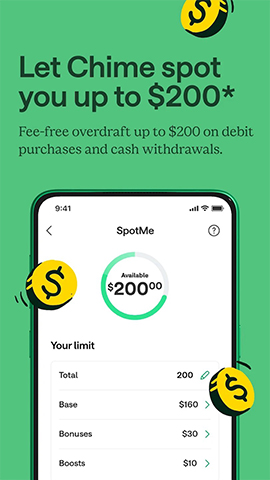

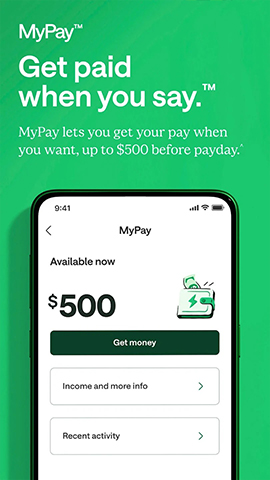

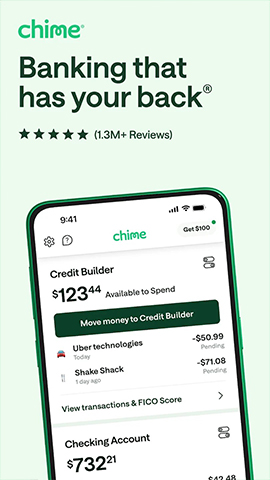

After completing the above steps, users can start using Chime's online banking services.

Chime account provides various functions, including transfer, bill payment, deposit, withdrawal, etc. Users can operate according to their own needs.

The funds in the account are stored in banks insured by FDIC, so the user's funds are relatively safe.

6、 Other precautions

Protecting personal information: When registering and using a Chime account, please be sure to protect your personal information and avoid disclosing it to others.

Understand account protection mechanisms: Understand the security protection mechanisms of Chime accounts, such as password reset, account locking, etc., so that timely measures can be taken to protect account security when needed.

Follow account updates: Regularly check account balance and transaction records to ensure account security.

Through the above steps, users can easily use Chime Mobile Banking to perform various online banking operations and enjoy convenient and worry free financial services.