How to play:

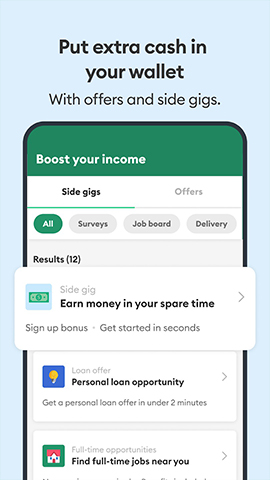

Brigit is an application designed to help users manage their finances and provide short-term lending services, while also dedicated to helping users establish or improve their credit. Here are some basic steps and suggestions on how to use Brigit: Borrow&Build Credit:

1. Download and register

Firstly, download the Brigit app on your smartphone. You can search for 'Brigit' in app stores such as the Apple App Store or Google Play Store and find it.

After installation, open the application and follow the prompts to register. You may need to provide personal information, bank account information, etc. so that Brigit can analyze your financial situation and provide corresponding services.

2. Connect bank account

In order to accurately analyze your financial situation and provide lending services, you need to connect Brigit to your bank account. This typically involves authorizing Brigit to access your account information (such as transaction records, balance, etc.).

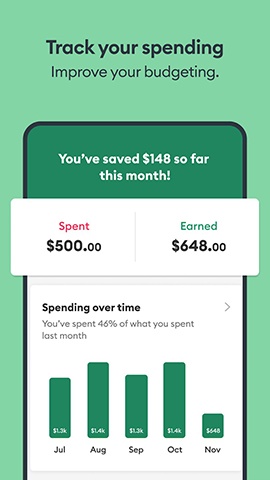

3. Setting preferences and monitoring

In Brigit, you can set your own financial preferences, such as the minimum account balance you want to maintain, borrowing and lending limits, etc.

Brigit will automatically monitor your bank account, and when your balance falls below the set minimum value, it will alert you and may provide short-term lending services to avoid overdrafts.

4. Borrowing and Repayment

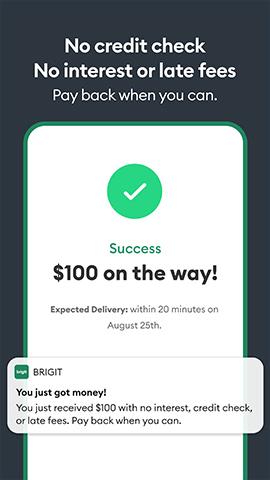

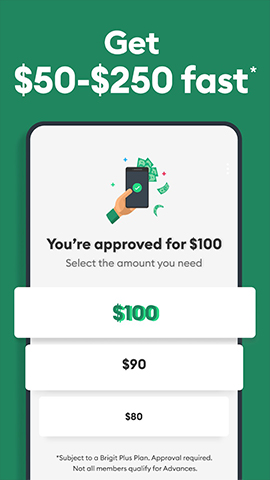

If your account balance is close to or below the set minimum value and you meet Brigit's lending conditions, it may offer you a small loan to help you get through the difficult times.

The loan amount and interest rate will be determined based on your personal financial situation and Brigit's assessment results. Please make sure to carefully read and understand the relevant terms and conditions before borrowing.

Repayments are usually automatically deducted from your bank account without the need for manual operation. Please ensure that there is sufficient balance in your account before the repayment date to avoid incurring overdue fees.

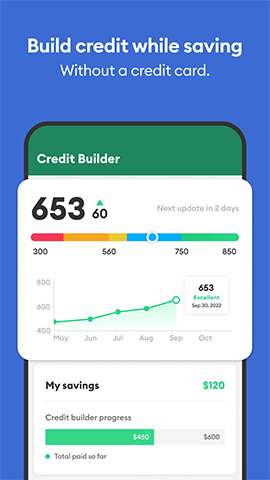

5. Establish or improve credit

Using Brigit's lending services and repaying on time can help you establish or improve your credit record. A good credit record is crucial for future applications for financial services such as loans and credit cards.

Note that although Brigit claims to help users establish or improve their credit, the specific effects may vary depending on individual circumstances. Therefore, when using Brigit, please be cautious and rational.

matters needing attention

When using Brigit or any other financial services, please be sure to pay attention to protecting personal information and account security.

Borrowing requires caution, please ensure that you fully understand the relevant risks and assess your repayment ability before borrowing.

If you encounter any problems or doubts, please contact Brigit's customer service team or relevant financial institutions for consultation and answers in a timely manner.

Overall, Brigit is a convenient and practical financial management tool that allows you to better manage your financial situation and strive to establish or improve your credit record by using its lending services wisely and repaying on time.