How to play:

Zelle is the most commonly used instant interbank transfer platform in the United States, primarily providing users with simple, fast, and secure peer-to-peer (P2P) transfer services. The following are the detailed steps for using Zelle:

1、 Confirm bank support

Firstly, it is necessary to confirm whether your bank has collaborated with Zelle. Most major banks and credit unions in the United States have joined the Zelle network, allowing users to use Zelle directly within the bank's application without downloading additional applications. You can check and confirm whether your bank supports Zelle on the list of partner institutions on Zelle's official website (www.zellepay. com/get started).

2、 Register a Zelle account

If the bank already supports Zelle, the registration process is usually simple:

Register through the bank application:

Log in to your bank application.

Search for Zelle transfer services, which are typically located under the "Transfer", "Payment", or similar menus.

Click to register or add Zelle service, follow the prompts to enter your email address or phone number, and accept a one-time verification code to complete the verification.

Associate your bank account with Zelle account.

Registration through Zelle application (if not directly supported by the bank):

Download and install the Zelle application on the device (available from the App Store or Google Play).

Open the application and click 'Register'.

Enter your email address and US mobile phone number (note that fixed phone numbers, Google Voice numbers, or Internet phone numbers cannot be used).

To verify the information, the system will send a PIN code to your phone or registration email. Enter the PIN code to complete the verification.

Associate your US bank account to ensure that it is part of online or mobile banking services.

3、 Use Zelle to transfer funds

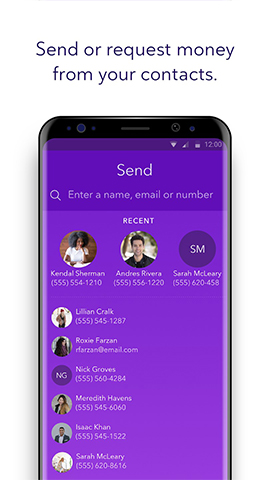

Add payee:

In the Zelle function of the Zelle application or banking application, click on "Add Payee".

Enter the name, phone number, or email address of the payee.

Verify the recipient's information to ensure accuracy.

transfer accounts:

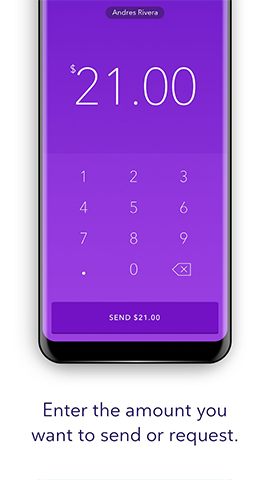

Click on the added payee and enter the transfer amount.

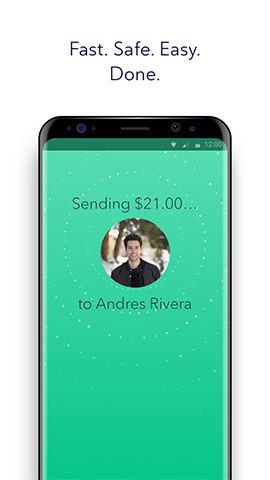

After confirming that the transfer information is correct, click the "Send" or similar button.

Funds will be instantly transferred from your bank account to the recipient's bank account.

4、 Precautions

Transfer limit: The transfer limit for different banks and accounts may vary, and the specific limit should refer to your bank policy. Generally speaking, the Zelle transfer limit of most banks is sufficient to meet daily transfer needs.

Irrevocable transfer: Once the transfer is completed, it is usually irrevocable. Therefore, it is essential to verify the recipient information and transfer amount before making a transfer.

Large scale transfers: Large scale transfers may attract the attention of banks and may require additional verification. If requested by the bank, please provide necessary documents and information to ensure the legality of the transaction.

Security: Zelle uses bank level security measures to protect users' funds and information. However, users still need to remain vigilant and avoid transferring funds to unknown or untrustworthy recipients.

Through the above steps, you can easily use Zelle for instant interbank transfers. Zelle's convenience and efficiency make it one of the preferred ways for US users to transfer money between each other.