How to play:

Afterpay is a payment method called Buy Now, Pay Later (BNPL), which allows consumers to purchase goods without having to pay the full amount in one go. Instead, it can be divided into multiple installments without interest or transaction fees during the installment period. Here are the specific steps to use Afterpay:

1、 Register an Afterpay account

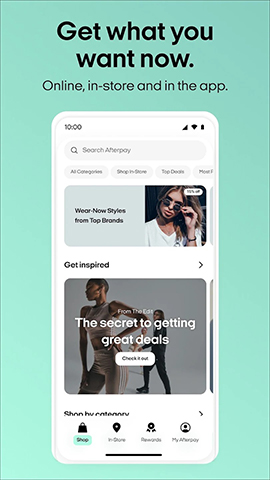

Visit the Afterpay official website or download the Afterpay app: First, you need to visit the Afterpay official website (please note that as I cannot provide specific links directly, you need to search for "Afterpay official website" to access it) or download the Afterpay app from your mobile app store.

Create an account: Follow the prompts on the official website or app to fill in personal information, including name, email address, password, etc., to create your Afterpay account. You also need to bind a valid debit or credit card for payment and repayment.

2、 Use Afterpay when shopping online

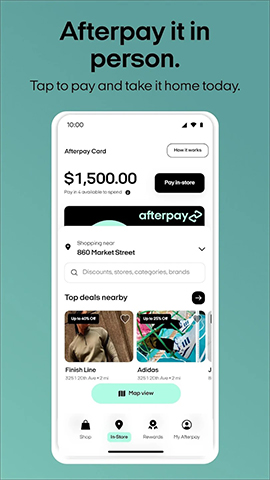

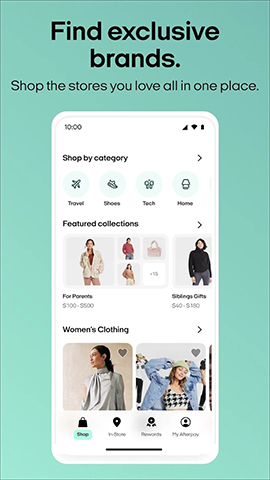

Select merchants that support Afterpay: On the official website or app of Afterpay, you can find a list of merchants that support Afterpay. You can also directly check on the merchant's website when shopping to see if Afterpay payment is supported.

Add products to shopping cart: Browse the products on the merchant's website, select the products you want to purchase, and add them to your shopping cart.

Choose Afterpay as your payment method: At checkout, select Afterpay as your payment method. The system will guide you to log in to your Afterpay account.

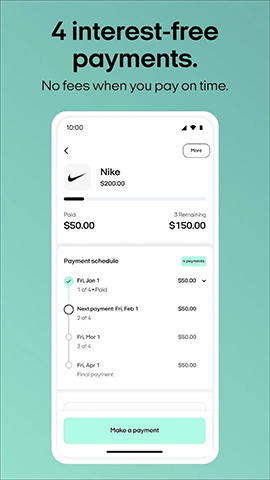

Confirm the order and make the down payment: After logging into your Afterpay account, confirm the order details, including product information, installment amount, and installment plan. Then, pay the down payment. Usually, the down payment will be deducted from your bank card immediately upon purchase.

3、 Subsequent repayment

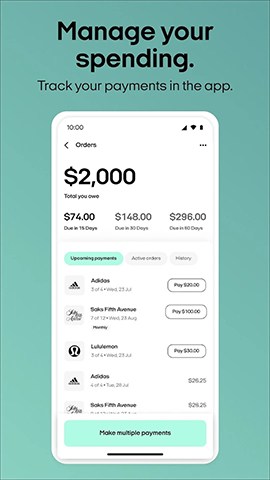

Receive repayment reminder: Afterpay will notify you of the subsequent repayment date and amount via email or application.

Timely repayment: Before the repayment date, ensure that there is sufficient balance in your bank card to pay the current amount. Afterpay will automatically deduct the amount from your bank card.

matters needing attention

Ensure timely repayment: Although Afterpay does not charge interest and handling fees, failure to repay on time may result in late fees or affect your credit score.

Understand installment plan: Before using Afterpay, it is important to understand your installment plan, including the number of installments, repayment amount for each installment, etc.

Protect account security: Ensure the security of your Afterpay account password and bank card information, and do not disclose them to anyone.

By following the above steps, you can easily use Afterpay for a buy now pay later shopping experience.